Tax cut for the middle class

a middle-class tax cut to help canadians get ahead

Published: July 11th, 2025

Affordability remains a top concern for families in Burnaby Central and across the country — and Canada’s new government is delivering real change to help.

This week, the Minister of Finance and National Revenue, the Honourable François-Philippe Champagne, announced a major tax relief measure that will benefit nearly 22 million Canadians.

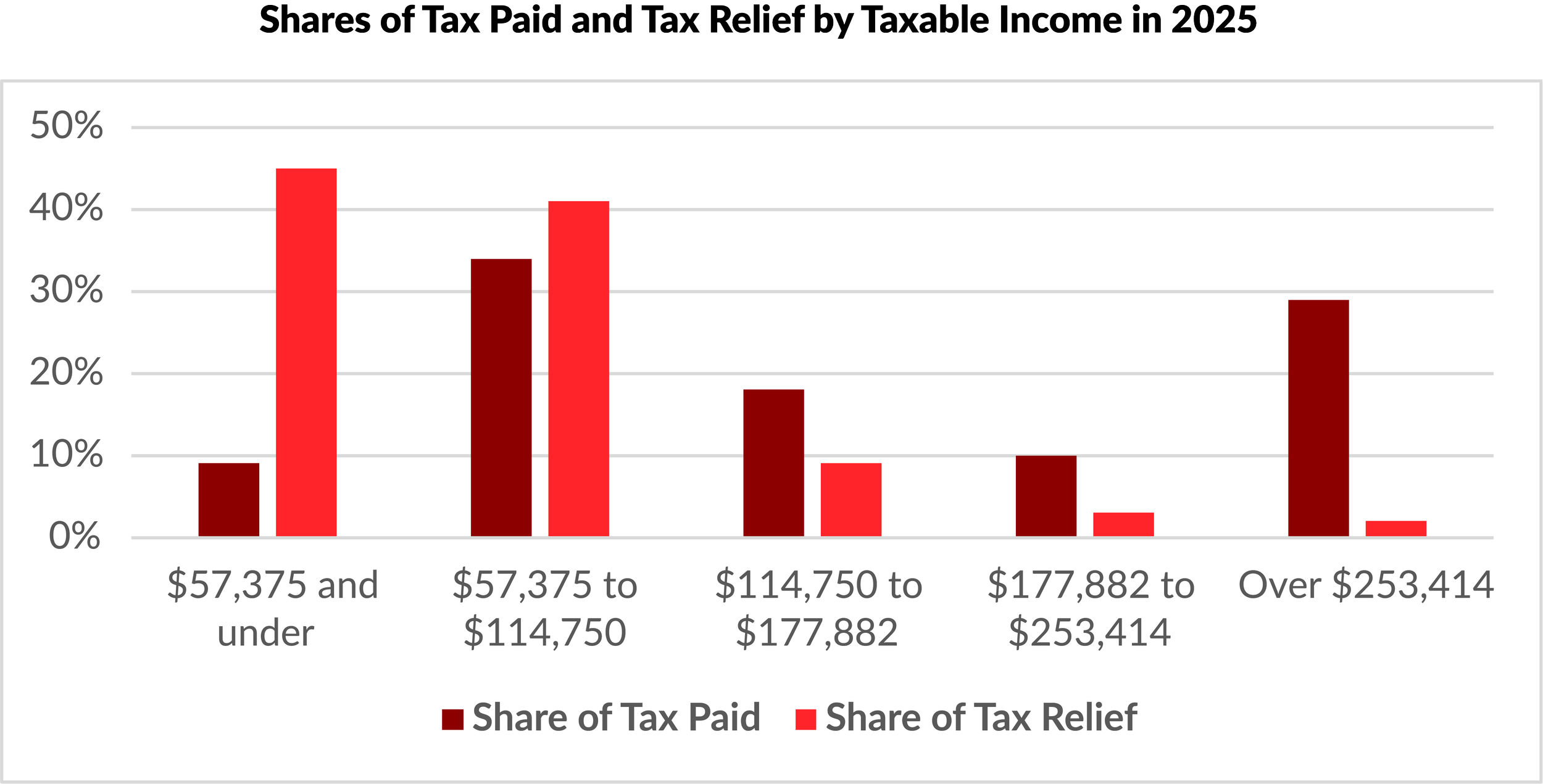

Starting July 1, 2025, the government is proposing to reduce the lowest personal income tax rate from 15% to 14%. Once passed into law, this middle-class tax cut could save working families up to $840 per year — putting more money back in people’s pockets at a time when they need it most.

What This Means for You:

Lower Taxes, More Savings: You’ll keep more of each paycheque — savings that can go toward groceries, child care, school supplies, or bills.

A Fairer Economy: This is one of the new government’s first priorities to help rebalance the economy in favour of everyday Canadians.

Immediate Action on Affordability: After calling for bold change, Canadians are now seeing action — with more to come.

how this helps burnaby central

Burnaby Central is home to a diverse and hard-working population — from young families to seniors on fixed incomes. Lowering the basic income tax rate means real relief for thousands of local residents who are feeling the squeeze from rising costs.

This tax cut will:

Put more money in the hands of Burnaby Central residents to spend at local businesses and support their families;

Help newcomers and working professionals build a stronger financial foundation;

Provide breathing room for families juggling housing costs, education, and daily essentials.

Our office is here to help answer any questions about how this may impact you. If you need assistance navigating benefits or tax programs, don’t hesitate to reach out.